Realtors offer help with tax assessments

Herald Staff Writer | Hagadone News Network | UPDATED 14 years, 2 months AGO

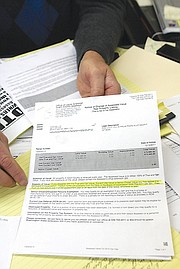

MOSES LAKE - Concerns about some increased tax assessments in Grant County prompted two Moses Lake realtors to help residents ask the county's Board of Equalization for lower assessments.

The public is invited to two separate open house events at Coldwell Banker Tomlinson and Gary Mann Real Estate in Moses Lake.

They are both planned for Saturday, from 10 a.m. to 2 p.m..

Coldwell Banker Tomlinson is located at 1000 Pioneer Way, and Gary Mann Real Estate is found at 305 E. Third Ave.

People will need to bring their current assessment to the event they choose to attend, Mann said.

The deadline to petition the county for a lower assessment is 30 days from the date you receive your notice, he said. For many people, the deadline is Jan. 13.

"It seems like there are a lot of people coming in, with questions on what to do," Mann said. "They can come in and get them answered."

Mark Fancher, Coldwell Banker Tomlinson's sales manager, said both customers and non-customers are coming to him with concerns about their assessments.

He tells them about the appeals process, but they must have comparables showing the values are too high.

One issue is the year one must pull comparables from, which dates from Dec. 31, 2010 and goes back, he said.

People cannot use 2011 sales for the comparables, he said.

The housing market in the Columbia Basin peaked in 2008, but the market decreased in value since the peak, Fancher said.

"So when they get an increased assessment, they scratch their head," Fancher said.

He doesn't know if he can deliver comparables to everyone on the day of the open house. They can at least start the process, he added.

Fancher points out the assessed valuation is different than actual taxes.

"We don't know what taxes are," he said. "They haven't been sent out."

It isn't known yet, because residents don't have their mileage rate to figure out taxes. The mileage rate is the amount per $1,000 used to calculate taxes on property.

The concern among some is if their assessments increase, their taxes increase.

If the mileage rate stays the same, taxes are going up, Fancher said.

Harold Hochstatter, of Moses Lake, said the assessed valuation of one acre of his land increased from $10,000 to $57,000.

"I have heard of other folks getting these intense increases," he said in part.

People fume about such issues, forget it and not do anything about it, he said.

But they want people to go to the Board of Equalization, he said.

For more information, call Coldwell Banker Tomlinson at 509-766-0300, Gary Mann Real Estate at 509-765-3463.

ARTICLES BY HERALD STAFF WRITER

Staatses plead not guilty

EPHRATA - The Moses Lake couple, accused of refusing to take their child to a hospital as the boy was starving, pleaded not guilty Tuesday.

Central Wash. Home Expo this weekend

MOSES LAKE - Basin residents wanting to build a new home, or renovate an existing one, can turn to next weekend's Central Washington Home Expo for inspiration.

Nurse practitioner program begins in Othello

Application deadline is May 15

OTHELLO - The Columbia Basin Health Association will start a training program for nurse practitioners, beginning in September. The program's application deadline is May 15.