Property assessment notices cause confusion

KAYE THORNBRUGH | Hagadone News Network | UPDATED 2 years, 6 months AGO

Kaye Thornbrugh is a second-generation Kootenai County resident who has been with the Coeur d’Alene Press for six years. She primarily covers Kootenai County’s government, as well as law enforcement, the legal system and North Idaho College. | June 10, 2023 1:09 AM

COEUR d’ALENE — As the 2023 property value assessment notices began hitting mailboxes, a note has reportedly caused confusion for many Kootenai County property owners.

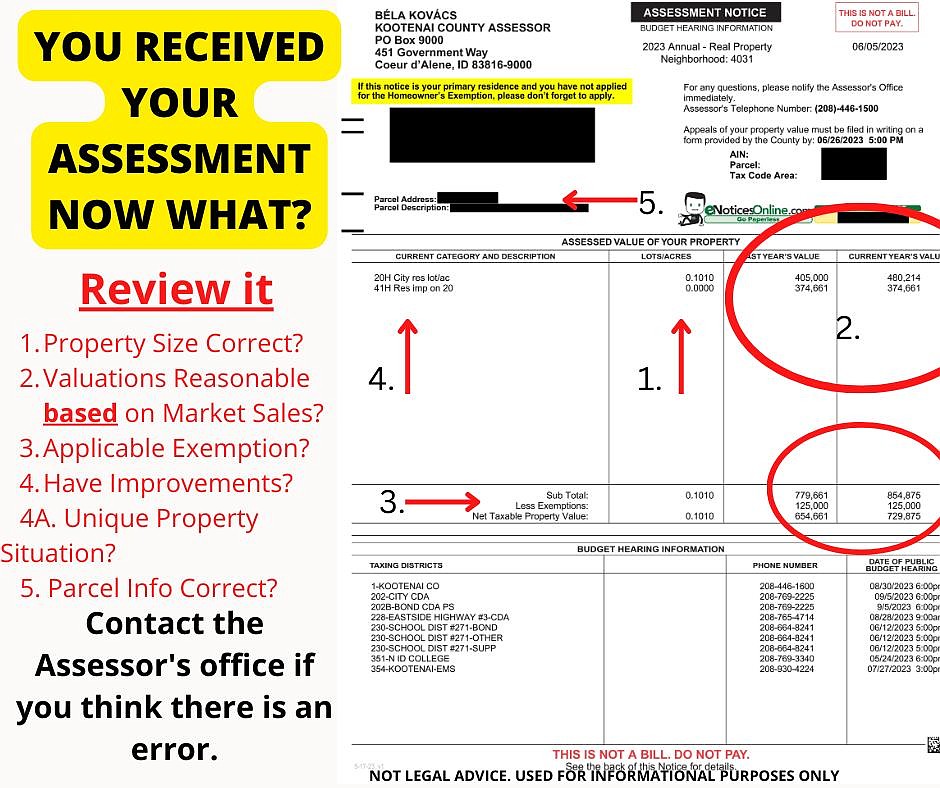

“If this notice is your primary residence and you have not applied for the Homeowner’s Exemption, please don’t forget to apply,” reads a line, highlighted in yellow, at the top of each assessment notice.

Hundreds of property owners, many of them elderly, have reportedly contacted the county assessor and treasurer, concerned they have lost their homeowner’s exemption and need to reapply.

But most of them need not worry.

Those who own and occupy a home as a primary residence may qualify for a homeowner’s exemption for that home, including manufactured homes, and up to 1 acre of land. This allows the value of the residence and land to be exempted at 50% of the assessed value, up to a maximum of $125,000.

If approved, the exemption is good until the owner moves and the home is no longer the primary residence, until the owner no longer owns the home, or until the home’s ownership changes, such as by being put in a trust.

Kootenai County Assessor Béla Kovacs declined to answer questions from The Press this week about the consternation over the homeowner’s exemption note or about this year’s property value assessments.

The Assessor’s Office is responsible for assessing the market values of more than 97,000 parcels.

Idaho law requires the county assessor to make, or attempt to make, a physical inspection of a property once in a five-year cycle. Otherwise, the assessor creates an assessed value for a property based on the sales of comparable homes in the area.

Last year, values soared for many property owners, prompting more than 700 appeals to the county Board of Equalization.

It’s unclear at this time if values have trended higher, lower or stabilized in 2023.

One Coeur d'Alene homeowner in the northern part of the city reported a decline in his property valuation since 2022, when his residence and land were assessed at nearly $640,000. This year, it's down to $555,000.

Another homeowner in Coeur d'Alene's downtown area said her property value increased again after a significant hike in 2022.

The county, on the Kootenai County Government Facebook page, encourages property owners to review their assessments.

"If you have questions please call, email, or write the Assessor's office, before 5 p.m., on Monday, June 26, 2023, (fourth Monday of June) so that we can make any needed corrections," said the Facebook post. "By state law, after the fourth Monday of June, any change or correction must be made by the Board of Equalization (BOE) 208-446-1500."

For information or to submit a question or comment, visit kcgov.us/176/Assessor.

ARTICLES BY KAYE THORNBRUGH

Rathdrum police seek victims amid burglary investigation

Rathdrum police arrested a suspect Tuesday who they believe to be involved in multiple burglaries, according to a news release.

BLM: Migrating eagle population peaked early this year

The annual migration of bald eagles to Lake Coeur d’Alene to feed on spawning kokanee is past its peak, according to the Bureau of Land Management.

North Idaho ski areas open after slow start

Amid challenges like warm temperatures and strong winds that caused power outages across the region, all three ski areas in North Idaho are open, though operations are limited in some cases.