Royal City approves 2024 property tax levy

GABRIEL DAVIS | Hagadone News Network | UPDATED 1 year, 2 months AGO

Gabriel Davis is a resident of Othello who enjoys the connections with his sources. Davis is a graduate of Northwest Nazarene University where he studied English and creative writing. During his free time, he enjoys reading, TV, movies and games – anything with a good story, though he has a preference for science fiction and crime. He covers the communities on the south end of Grant County and in Adams County. | November 9, 2023 6:06 PM

ROYAL CITY — Tuesday’s regular Royal City City Council meeting featured two public hearings on the 2024 budget revenue sources and the 2024 property tax levy, as well as a vote on the levy, which passed unanimously.

Royal City Finance Director Janice Flynn introduced the levy.

“We have the certified levy request amount of $150,000 and an administrative refund amount of $1,555.15. That is based on this year's amount received, $99,442.32, and you can add 1% to that … plus new construction.”

The additional levy amount resulting from new construction is not capped by the regular annual 1% property tax levy increase.

The Municipal Research and Services Center of Washington’s November 2023 Revenue Guide for Washington Cities and Towns explains the administrative refund.

“In some situations, the city may have to refund property taxes paid by individual property owners or cancel property taxes that were due but not yet paid,” said the guide. “A city may choose whether an administrative refund should be included in the following year’s levy, thereby reducing the levy amount received by the amount of the administrative refund, or to levy for the refund.”

Royal City will be levying the refund amount.

“It's a refund to the city, which means it makes the levy a little higher, so we get the money but it's a little more money that the taxpayers have to pay, the property owners…Most of that refund comes from the senior exemptions that the senior citizens who qualify get, so they pay a lesser amount. Basically, that amount goes to the other taxpayers.”

The MRSC Revenue Guide also specifies that the 1% annual increase does not translate directly to a 1% increase for property owners.

“Because the assessed valuations of different properties fluctuate at different rates depending upon market conditions, some property owners may see their property taxes go up much more than 1%, while other property owners may simultaneously see their property tax bills decrease.”

There was no public comment on the 2024 revenue sources or the property tax levy, and there was no public comment on the preliminary budget hearing at the Oct. 19 regular council meeting, according to the meeting minutes.

The Oct. 19 council agenda packet provided Royal City’s 2024 preliminary budget. It lists the city’s total beginning balance at $6.4 million, its projected revenues at $7.6 million, its projected expenses at $8.3 million and its projected balance at the end of 2024 as $5.7 million.

According to the Oct. 19 meeting minutes, Bob Murphy, with the Royal City Golf Course, requested additional funds of $25,000 toward equipment purchases if needed. The council unanimously approved the payment. Also at the previous meeting, a motion was unanimously approved to nominate Ryan Piercy as the Mayor Pro Tem.

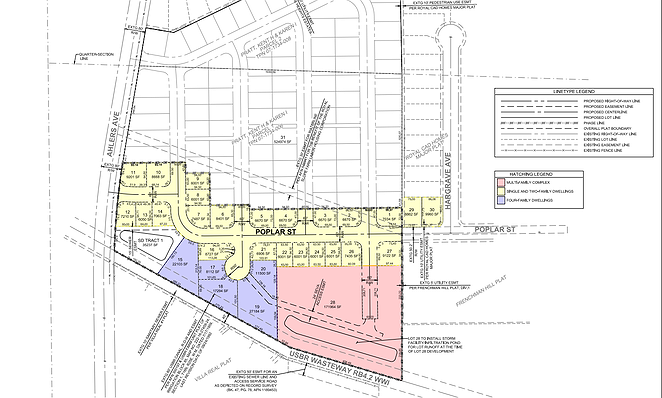

At Tuesday’s meeting, Alex Kovach provided an update on CAD Homes’s preliminary plat submittal for the first phase of the future Pratt Hills residential subdivision. According to the plat submittal, the development will be located on the north side of the canal between the end of Poplar Street and Ahlers Avenue.

Kovach requested that he and CAD Homes be given a little more time to make adjustments to the preliminary before the council votes on it. The council agreed to look at the proposal at one of the next two council meetings.

Gabriel Davis may be reached at gdavis@columbiabasinherald.com.

Royal City City Council members listen to Finance Director Janice Flynn as she explains the city’s 2024 property tax levy.

Royal City City Council members listen to Finance Director Janice Flynn as she explains the city’s 2024 property tax levy.ARTICLES BY GABRIEL DAVIS

Work-based learning lets students build their own futures

MOSES LAKE — Work-based learning provides education opportunities for the workforce to receive hands-on training and technical education and prepare themselves to enter various industries. Educators and workforce development professionals from Eastern Washington discussed some the training they offer and the benefits of their programs. Next Generation Zone, an affiliate of WorkSource based in Spokane, provides job training opportunities for youth and young adults ages 16 to 24. Program Coordinator Kate Martin said there are multiple benefits to the program. “One of them is a paid work experience, and that’s where we reach out to area employers who are willing to take a young person and train them,” she said. “This is a short-term learning experience, so it’s typically about 240 hours; sometimes it could be longer or shorter. We’re the actual employer; we cover all of their wages, taxes, the L&I, and the employer just agrees to give them the experience and train them in whatever field it is that they’re wanting to go into.”

Serving schools: ESD superintendents reflect on operations, priorities

MOSES LAKE — Educational service districts are government-mandated agencies put in place to provide services to school districts across the state. ESD Superintendents discussed what they do and their priorities in operating their districts. ESD 105, led by Superintendent Kevin Chase, serves four counties, including Kittitas, Yakima and portions of Klickitat and Grant counties and provides support for 25 school districts – including Royal School District and Wahluke School District – and more than 66,000 students. “We help them collaborate with each other as well or collaborate with other partners,” Chase said. “(It’s) a lot of advocacy work, either regionally or across the state, or even federally, working on different issues that impact our education. And we provide very specialized services in certain situations in order to meet the needs of our students in our region and of our school districts.”

Columbia Basin Project making headway through Odessa Groundwater program

CASHMERE — The Columbia Basin Project is making gradual progress toward completion with particularly significant accomplishments for the Odessa Groundwater Replacement Program in the last six months or so, according to Columbia Basin Development League Executive Director Sara Higgins. “When we’re dealing with a project of this size, advancement is kind of like watching paint dry, but yes, there have been (developments),” she said. “There are a lot of exciting things happening right now.” There are more than 300 miles of main canals, about 2,000 miles of lateral canals and 3,500 miles of drains and wasteways in the irrigation project, according to the U.S. Bureau of Reclamation website. The CBDL advocates for the operation of those waterways and for the project to continue “build-out.”